Charting the Future: How Tanzania is Redefining Financial Services in East Africa

If you’ve spent any time in Dar es Salaam, Arusha, or virtually any town in Tanzania, you’ve witnessed it. It’s the ubiquitous chime of a mobile money transaction, the flash of a QR code at a local market stall, the ease with which school fees, utility bills, and daily groceries are paid for not with cash, but with a few taps on a simple feature phone or a smartphone. For years, Tanzania has been a global leader in mobile money adoption, a revolution that fundamentally altered the country's economic fabric. But to see this as the final destination would be to miss the bigger picture. This initial wave was just the beginning.

Today, Tanzania stands at the precipice of a second, more profound financial revolution. A dynamic and rapidly expanding Financial Technology (FinTech) ecosystem is building upon the robust foundation of mobile money, moving beyond simple peer-to-peer transactions to offer a sophisticated suite of financial services. From instant micro-loans and accessible insurance products to digital savings platforms and streamlined business payments, FinTech is reshaping the relationship between Tanzanians and their finances. This is not merely about convenience; it is about building a more inclusive, resilient, and dynamic economy for all. This post will explore the key drivers fueling this transformation, the emerging trends defining its trajectory, the critical challenges that must be navigated, and the immense potential that lies ahead for FinTech in the digital savannah of Tanzania.

The Foundation: How Mobile Money Sowed the Seeds of Trust

To understand where Tanzanian FinTech is going, one must first appreciate the ground-breaking impact of mobile money. The stratospheric success of services like M-Pesa, Tigo Pesa, and Airtel Money wasn't an accident; it was a direct response to a market need. In a country with a vast geographical landscape and, at the time, limited traditional banking infrastructure, these platforms offered a revolutionary proposition: a bank in every pocket. They bypassed the need for brick-and-mortar branches, enabling millions of unbanked and underbanked citizens to send, receive, and store money securely for the first time.

The statistics are a testament to this success. The FinScope Tanzania 2023 survey revealed that a staggering 72% of the adult population now uses mobile money services. This widespread adoption did more than just move cash into a digital format. Critically, it served as a national-scale digital finance academy. It accustomed a generation of Tanzanians to the concepts of digital wallets, PIN security, and electronic transactions. It built a foundational layer of trust and familiarity with financial technology, creating a fertile ground from which more complex and ambitious FinTech solutions could grow. Mobile money was the gateway drug to a fully digital financial life, and the nation’s entrepreneurs and innovators took notice.

The Drivers of the Current FinTech Boom

The transition from a mobile-money-dominated landscape to a diversified FinTech ecosystem is being propelled by a powerful confluence of factors.

First and foremost is a supportive government and regulatory environment. The Bank of Tanzania (BoT) has not acted as a gatekeeper but as a cautious facilitator of innovation. Through initiatives like the National Financial Inclusion Framework, the government has explicitly recognized FinTech as a critical tool for achieving national development goals. The establishment of regulatory sandboxes allows promising startups to test their products in a controlled environment without facing the full weight of banking regulations from day one. This forward-thinking approach signals to both local and international investors that Tanzania is open for business.

Second, the demographics and technological adoption rates are incredibly favorable. Tanzania has a large, young, and increasingly urbanized population. This digital-native generation has embraced smartphones and the internet with enthusiasm. Rising connectivity, even in rural areas, and the decreasing cost of data are expanding the addressable market for app-based financial services at an explosive rate. This creates a direct channel for FinTech companies to reach customers without the massive overhead of physical infrastructure.

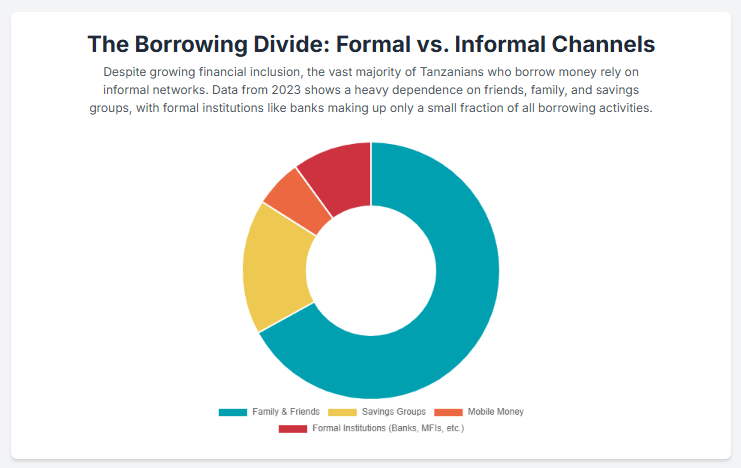

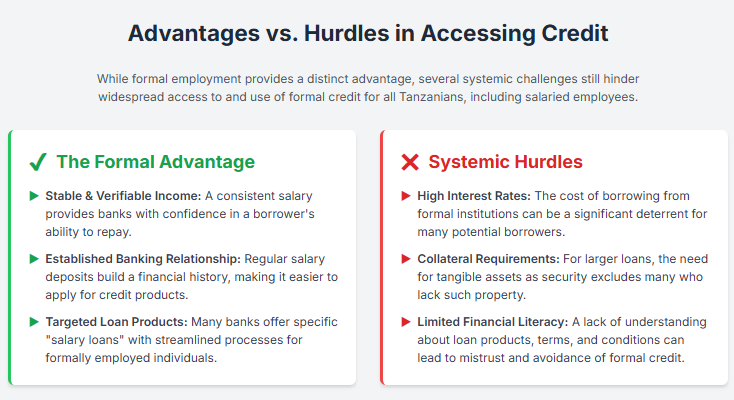

Finally, the vibrant Small and Medium Enterprise (SME) sector presents a massive opportunity. SMEs are the lifeblood of the Tanzanian economy, yet they have historically been one of the most underserved segments by traditional banks. Lacking the extensive credit histories and physical collateral often required for conventional loans, many have been locked out of the formal credit system. FinTechs are stepping into this gap with innovative solutions. By leveraging alternative data points—such as mobile money transaction history and supplier payments—they can build more inclusive credit scoring models, offering SMEs the working capital they need to grow, hire, and formalize their operations.

Beyond the Transaction: The New Wave of FinTech Services

The current wave of innovation is moving far beyond the simple payment and transfer services that defined the first era of mobile money.

Digital Lending is arguably the most disruptive trend. A multitude of platforms now offer instant, unsecured micro-loans directly through mobile apps. For an employee facing an unexpected medical bill or a small business owner needing to purchase inventory, the ability to receive funds in minutes is life-changing. However, this sector is not without its perils. Exorbitantly high interest rates, aggressive debt collection practices, and the risk of trapping vulnerable borrowers in cycles of debt are significant concerns that demand robust consumer protection and a focus on responsible lending.

InsurTech is another burgeoning frontier. For decades, insurance penetration in Tanzania has been extremely low, often perceived as a complex and expensive product reserved for corporations and the wealthy. Technology is changing this narrative. Startups are now offering affordable, accessible micro-insurance products. A farmer can insure her crops against drought for a small premium paid via mobile money, or a family can secure basic health coverage through a simple USSD menu. This makes financial safety nets available to a much broader segment of the population.

Simultaneously, digital payments are evolving. The integration of payment gateways into e-commerce platforms is fueling the growth of online retail. More importantly, the government's push for digital payments through platforms like the Government Electronic Payment Gateway (GePG) is formalizing vast swathes of the economy. When taxes, levies, and public service fees are paid digitally, it increases transparency, reduces corruption, and improves efficiency.

Navigating the Inevitable Challenges

The road ahead is not without its obstacles. The digital divide, while narrowing, remains a significant barrier. The quality and affordability of internet access can vary dramatically between Dar es Salaam and a remote village, and digital literacy is not yet universal. Ensuring that the FinTech revolution does not leave rural and less-educated populations behind is a critical task for both policymakers and private sector players.

Furthermore, as the volume of digital financial data grows, so too do the risks associated with cybersecurity and data privacy. Building and maintaining the trust that mobile money established is paramount. A single high-profile data breach or fraud scandal could set the industry back years. This requires continuous investment in robust security infrastructure and the enforcement of clear, comprehensive data protection laws.

Finally, the challenge of financial literacy cannot be overstated. Providing access to a loan or an investment product is only half the battle. Citizens must be equipped with the knowledge to understand the terms, evaluate the risks, and make informed decisions that improve, rather than imperil, their financial health.

The Future is Inclusive

Tanzania's FinTech journey is a compelling story of leapfrogging technological development. By building on a world-class mobile money foundation, the nation is now in the process of constructing a sophisticated and diversified digital financial ecosystem. The potential is immense: to provide a smallholder farmer with crop insurance, to give an urban entrepreneur the capital to expand her business, to help a young family save for their future, and to bring millions more into the formal economy.

The challenges of infrastructure, security, and education are real, but so is the momentum. With continued collaboration between innovative startups, forward-thinking regulators, and an eager population, the future of finance in Tanzania is bright. It is a future that is not just digital, but more democratic, more accessible, and more inclusive for every single citizen.