Forget Silicon Valley: The Unlikely Blueprint for Tech Success in Tanzania

Tanzania's technology sector is a fascinating study in contrast. On one hand, the nation is home to a youthful, digitally engaged population, with over 60% of its inhabitants under the age of 25, and a remarkable 86% increase in internet subscriptions between 2020 and 2024. The government has articulated an ambitious vision for a digital future through initiatives like the Digital Tanzania Program and the Tanzania Digital Economy Strategic Framework (DESF) 2024-2034. This combination of demographics and policy intention paints a picture of a nation on the cusp of a tech revolution.

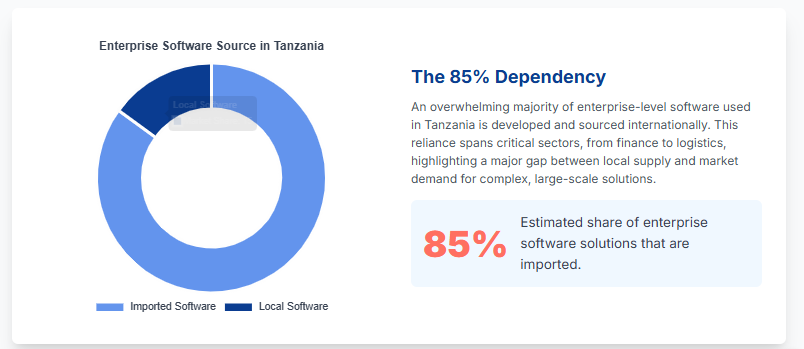

Yet, despite this immense potential, the on-the-ground reality for local software companies is often one of struggle and failure. The market is still dominated by foreign solutions, and the local startup ecosystem, while growing, lags significantly behind regional peers like Kenya and Rwanda . This raises a critical question: where do local software companies fail, and why are major solutions still imported? The answer lies not in a single flaw but in a complex web of systemic barriers and a fundamental market paradox. However, a new wave of homegrown success stories is emerging, proving that a different kind of innovation—one built on local needs, not global imitation—is the true path to a thriving software industry.

The Invisible Walls: The Root Causes of Local Failure

The journey for a Tanzanian tech startup is an uphill climb, met by a series of entrenched challenges that often prove insurmountable.

The Policy and Regulatory Maze: For many entrepreneurs, navigating Tanzania's regulatory landscape is a "shit show" of bureaucratic delays and "red tape". The process of obtaining licenses and approvals can be a frustrating and slow-moving affair. Some in the community even view these barriers as a deliberate mechanism to control innovation and protect "money loopholes" for those in positions of power. A recent example is the Business Licensing (Prohibition of Business Activities for Non-Citizens) Order, 2025, which bans non-citizens from engaging in a list of business activities, including mobile money transfers and courier services. While the intent may be to protect local businesses, such protectionist measures can deter the foreign investment and expertise that a young ecosystem needs to grow.

The Funding Drought and High Capital Costs: Beyond the regulatory headaches, access to capital is a major hurdle. The availability of venture capital and angel investors is limited compared to more mature African tech hubs.This scarcity is compounded by high capital costs, with annual interest rates on loans often exceeding 20%.As a result, 38% of African startups collapse due to cash flow issues. Without sufficient funding, even the most promising ideas struggle to get off the ground or scale.

The Persistent Skills Gap: A core challenge facing the industry is a profound talent deficit. A staggering 70% of African companies report difficulty finding skilled professionals, and in Tanzania, only 25% of workers possess strong digital skills. This forces companies to either invest heavily in training or, more often, to rely on expensive foreign talent, which drives up operational costs. The education system is frequently cited as a root cause, as it often fails to equip students with the critical thinking and problem-solving skills demanded by the dynamic tech sector.

The "Copy-and-Paste" Problem: A significant number of local startups fail not because their technology is poor, but because they lack "product-market fit".This happens when entrepreneurs mistakenly replicate business models that succeeded in Western markets without adapting them to the unique local context. An e-commerce platform that mirrors a model from a developed country, for example, might fail to account for local barriers like unreliable logistics and lower internet penetration in rural areas.

The Import Paradox: A Question of Trust and Scale

Given these challenges, the reliance on imported software solutions becomes more understandable. Even with policies that impose a 15% withholding tax on foreign software payments and an 18% reverse charge VAT on imported services , major corporations and government bodies still prefer to buy from abroad. This is the central paradox of the Tanzanian software market.

The decision is driven primarily by a perception of quality, trust, and scalability. Foreign software, often developed by globally recognized brands, offers a proven track record that is invaluable for enterprises implementing mission-critical systems. The financial cost of a flawed local implementation or a system failure for a major bank or a government entity far outweighs the additional expense of taxes on a reliable, globally recognized solution. For these major clients, the perceived risk of using local, unproven software is simply too high.

Furthermore, a cultural and systemic issue related to software monetization compounds the problem. The widespread prevalence of illegal, "virus-infested" copies of popular software like Microsoft Windows and Office demonstrates a lack of a formal, paid-for software economy . In this environment, it becomes incredibly difficult for local startups to build sustainable business models based on a paid product or subscription . The market is effectively split: those who can afford and trust foreign solutions will pay the high cost, while the rest of the market defaults to illicit or informal alternatives.

The New Vanguard: Homegrown Success Stories

Despite these significant obstacles, a new generation of Tanzanian software companies is emerging and thriving by pioneering a new model of success. They are not competing with foreign giants on their own terms, but rather building innovative, bespoke solutions that address deeply localized problems.

Entice Technologies: A powerful example is Entice Technologies, a custom software development company that has proven local firms can deliver world-class, enterprise-grade solutions. Their work on the "AccessMD" Hospital Information System for Muhimbili National Hospital, Tanzania's largest referral hospital, serves as a powerful case study. The system digitized patient records, streamlined appointments, and integrated lab systems, leading to a stunning 75% reduction in patient wait times and a 90% improvement in record accuracy. This success demonstrates that a local team can solve a massive, complex, and localized problem with world-class technical competence, a feat that would be difficult for an imported, off-the-shelf solution to replicate.

Ramani: This logistics and supply chain company has succeeded by addressing a uniquely local problem with an innovative business model. Ramani uses artificial intelligence to provide inventory on credit to micro-distributors who typically lack access to formal financing. By providing a mobile application for digital sales tracking, the company not only provides a vital financial service but also generates valuable insights into market trends. The success of Ramani is not just a local story; it has been validated with funding from Y-Combinator, one of the world's most valuable accelerators.

Dawa Mkononi: Operating in the healthtech sector, Dawa Mkononi tackles a critical issue: the pharmaceutical supply chain. The company's B2B mobile application allows health facilities to easily and safely procure medicines from registered manufacturers and importers . This platform directly combats the spread of counterfeit drugs and streamlines logistics, a life-critical challenge that imported solutions are not designed to address . With over 1,500 registered facilities and having facilitated over $300,000 in purchases, Dawa Mkononi has shown a clear path to market impact .

Medikea: Medikea’s success lies in its hybrid model, which combines telemedicine with physical clinics to provide affordable and convenient healthcare to underserved communities. The company's focus on cost-effective, high-quality care directly addresses a critical developmental challenge in Tanzania. Medikea shows that solutions built on the principles of affordability and convenience for vulnerable populations have the potential for significant social and commercial success.

A Path to the Future

The success of these companies provides a clear blueprint for the future of Tanzania’s software industry. The most sustainable and impactful solutions are those that solve a problem that is uniquely Tanzanian. The path forward is not in imitating foreign models, but in a concerted effort by policymakers, investors, and entrepreneurs to create a more fertile ground for this kind of innovation.

The government must close the gap between its strategic vision and the on-the-ground reality by streamlining regulatory processes and creating a predictable and transparent environment for startups. Investors should diversify their focus beyond the prevalent fintech sector to include high-potential areas like healthcare, logistics, and agriculture. Finally, the country must bridge the skills gap through long-term educational reform and industry-led training programs that foster critical thinking and a mindset of innovation.

Tanzania's software ecosystem stands at a crucial juncture. By fostering an environment where entrepreneurs are encouraged to solve their own nation's problems, the country can move beyond its reliance on imported solutions and build a truly homegrown, self-sufficient, and globally competitive digital economy.