Tanzania's Tech Revolution Isn't About Apps, It's About Survival. Here's Why.

Forget the metaverse, AI-powered selfie filters, and apps that deliver artisanal ice cream in ten minutes. In the bustling tech hubs of Silicon Valley, innovation often chases convenience and entertainment. But half a world away, in Tanzania, a different kind of tech revolution is quietly unfolding. It’s less about luxury and more about lifeblood. Here, technology isn't a distraction; it's a tool for survival, a catalyst for fundamental change, and the most promising solution to challenges that have plagued the nation for generations.

While Western headlines buzz about the next social media giant, Tanzanian innovators are asking far more critical questions. How can a solar panel keep a rural clinic’s vaccine refrigerator running? How can a simple SMS message tell a farmer the real-time market price for her maize, saving her from predatory middlemen? How can a drone deliver life-saving blood to a woman in childbirth miles from the nearest paved road?

This is the face of innovation on the ground in East Africa. It’s gritty, essential, and profoundly impactful. The challenges are immense—spanning energy, healthcare, agriculture, and finance—but the solutions emerging are tailored, resilient, and built for the reality of Tanzanian life. This isn't about importing foreign ideas; it's about building a future from the ground up, one practical solution at a time.

The Energy Gap: Lighting Up the Nation, One Solar Panel at a Time

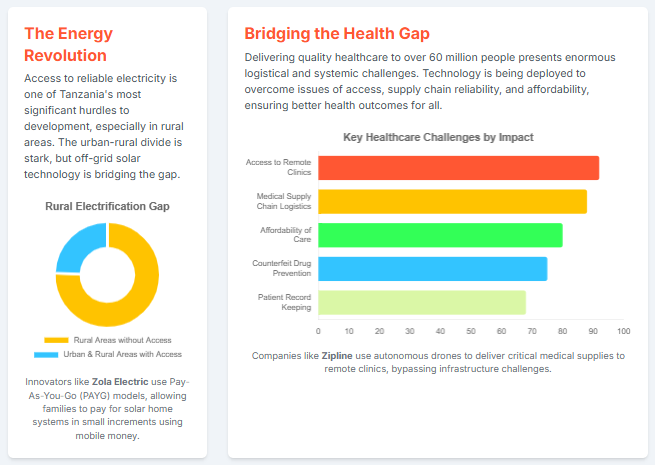

The hum of a generator is the unofficial soundtrack for many Tanzanian businesses and homes. With a national electrification rate hovering around 40% and dropping to as low as 24.5% in rural areas, access to reliable power is not a given. This "energy poverty" stifles economic growth, limits educational opportunities for children after sunset, and compromises healthcare delivery.

The Silicon Valley solution might be a smart-grid optimization algorithm. The Tanzanian solution is far more direct: decentralized, off-grid solar. Companies have pioneered a model that is revolutionizing energy access. Instead of a prohibitive upfront cost, families can use mobile money to make small, daily payments for a solar home system—a concept known as Pay-As-You-Go (PAYG).

A leader in this space is Zola Electric (formerly known as Off Grid Electric). They don't just sell a solar panel; they sell a reliable power service. For a small, affordable fee, a household gets panels, a battery, lights, and charging ports. This simple intervention transforms lives. A shopkeeper can stay open later, a student can study at night, and a family can power a radio or a small TV, connecting them to the wider world. It's a powerful example of how technology, combined with an innovative business model (leveraging the ubiquity of mobile money), can leapfrog traditional, slow-moving infrastructure development.

The Last Mile Health Challenge: Drones, Data, and Dignity

Imagine being a doctor in a remote village. Your clinic is understocked, the nearest hospital is a treacherous day's journey away, and you have no way of knowing if the medicine you're administering is genuine or a dangerous counterfeit. This is the reality for millions in Tanzania. The healthcare system is stretched thin, and the "last mile" of the supply chain—getting critical supplies to remote clinics—is often where it breaks down.

Enter Zipline. This US-based company, operating a major distribution center in Tanzania, uses a fleet of autonomous drones to deliver medical supplies on demand. A health worker can place an order via text message, and within minutes, a drone is launched, dropping a package of blood, vaccines, or medicine by parachute precisely where it's needed. It sounds like science fiction, but it's happening every day, saving countless lives by overcoming impassable roads and logistical nightmares.

Beyond logistics, technology is tackling other health challenges. Medikea, a local startup, is building a network of tech-enabled micro-clinics to provide affordable, accessible primary care. Meanwhile, companies like Jamii Africa have focused on making health insurance accessible to the low-income population through a mobile-based micro-insurance platform. For just a few dollars a month, users can get coverage, all managed through their phone. These aren't flashy, billion-dollar solutions; they are targeted, tech-driven interventions that provide a safety net where none existed before.

The Agricultural Disconnect: From Information Scarcity to Digital Harvest

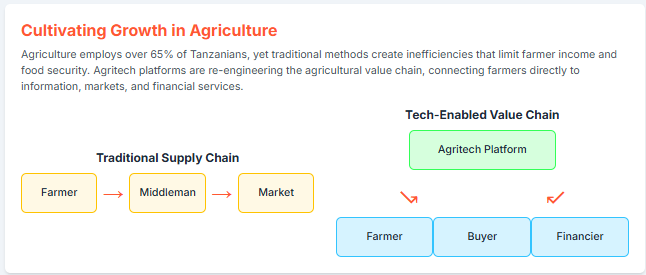

Agriculture is the backbone of the Tanzanian economy, employing over 65% of the population. Yet, the smallholder farmers who feed the nation are often trapped in a cycle of poverty by a lack of access—to information, to markets, to financing, and to quality farm inputs. They plant and pray, with little data to guide their decisions.

Agritech startups are systematically dismantling these barriers. Mobile platforms are now providing farmers with crucial information delivered via SMS or simple apps. This includes localized weather forecasts, advice on pest control, and, most importantly, real-time market pricing information. This knowledge is power. A farmer who knows the going rate for her crops in the city is no longer at the mercy of the first middleman who shows up at her farm gate.

While many platforms are emerging, the principle is shared: connect farmers directly to the agricultural value chain. This includes linking them to suppliers of certified seeds and fertilizers, connecting them to buyers to ensure fair prices, and partnering with fintech companies to provide much-needed credit. The mobile phone is evolving from a communication device into a powerful tool for modern farm management, increasing yields, boosting incomes, and ensuring food security.

The Financial Inclusion Divide: Beyond Mobile Money

The rise of mobile money in Tanzania, led by giants like Vodacom's M-Pesa and Tigo Pesa, is one of the world's great tech success stories. It has provided basic financial services to tens of millions of people who were previously unbanked. But this is just the foundation. The next wave of innovation is about building on that payment infrastructure to offer more sophisticated financial products.

The challenge is that for most Tanzanians, a formal credit history doesn't exist. How can a small business owner get a loan to buy more inventory when she has no bank records? Local fintech startups like NALA are tackling this by creating intuitive, user-friendly payment apps that work even in low-connectivity environments. While initially focused on simplifying payments, the data generated by these transactions is incredibly valuable. It can be used to build alternative credit scores, opening the door for micro-loans, insurance, and investment products that were previously out of reach for the informal sector. This is how you build a truly inclusive digital economy—not by trying to replicate the Western banking system, but by creating something new, built for the local context and powered by mobile technology.

The revolution in Tanzania is not being televised on global news networks. It’s happening in the quiet glow of a solar-powered lightbulb in a rural home. It's in the buzz of a drone carrying life-saving medicine. It’s in the ping of a text message confirming a fair price for a harvest. This is technology with a clear purpose: to build a more equitable, prosperous, and resilient future for all Tanzanians. And in a world often obsessed with the trivial, that is the most revolutionary idea of all.