The $800 Million Question: Why Kenya is Winning the Venture Capital Race and How Tanzania Can Fight Back

Imagine two entrepreneurs. One sits in a bustling co-working space in Nairobi, pitching her logistics startup to a venture capitalist who just flew in from London. The other, with an equally brilliant fintech idea, navigates the traffic of Dar es Salaam, preparing for a meeting with a local bank official. While both possess the same drive and ingenuity, the entrepreneur in Nairobi is operating in a different reality—one that is orders of magnitude more likely to result in a multi-million-dollar investment.

This isn't a hypothetical scenario; it's the current state of East Africa's innovation landscape. A staggering gap in venture capital (VC) funding and ecosystem maturity separates Kenya and Tanzania. In the first half of 2022 alone, Kenyan startups raised an estimated $820 million. During a similar period, Tanzania's notable deals totaled just over $42 million. This isn't a reflection of a difference in talent, but a chasm in the foundational pillars that allow talent to flourish: a supportive policy environment, a frictionless business landscape, and a mature ecosystem network.

While Tanzania shows promising signs of growth, currently ranking 490th on the Global Startup Ecosystem Index—a significant jump from 536th the previous year—it still lags far behind Kenya, which sits comfortably at 183rd. The World Bank's 'Ease of Doing Business' report tells a similar story, with Kenya ranked 56th globally, while Tanzania is a distant 141st.

This disparity presents an urgent, multi-million-dollar question for Tanzania: Why is its neighbor so far ahead, and what strategic decisions can be made to not only close the gap but forge a unique path to becoming an African innovation powerhouse?

Deconstructing the "Silicon Savannah": Why Investors Flock to Kenya

Kenya's success is not an accident. It is the result of years of deliberate policymaking, organic community building, and a government that understood the economic power of a thriving tech sector.

1. The Policy Pillar: A Clear Signal to the World

The cornerstone of Kenya's investor-friendly climate is its proactive legal framework. The country has passed a Startup Act, a critical piece of legislation that formally recognizes and defines startups, separating them from traditional Small and Medium-sized Enterprises (SMEs). This Act provides tangible benefits, including tax incentives, easier access to public contracts, and robust intellectual property protection.

For an international VC, this Act is more than just a document; it's a powerful signal. It demonstrates that the government understands the unique needs of high-growth, high-risk ventures and has created a predictable, supportive environment for them. This legal clarity drastically reduces perceived risk, making it far easier for investors to write checks.

2. The Business Environment: Removing Friction

A favorable Ease of Doing Business ranking is a direct catalyst for investment. Kenya's score reflects a reality were registering a company, dealing with construction permits, and trading across borders are relatively streamlined processes. This operational efficiency is paramount for startups that need to move quickly. Time spent navigating bureaucracy is time not spent building a product or acquiring customers. When a VC firm evaluates potential markets, the country that allows its portfolio companies to launch and scale with the least friction will always have a competitive advantage.

3. The Ecosystem Maturity: A Virtuous Cycle

Beyond policy, Nairobi boasts a dense, mature, and interconnected ecosystem. It is home to a higher concentration of world-class incubators, accelerators (like the famed iHub), and both local and international VC funds. This creates a powerful network effect.

Crucially, Kenya has seen a generation of successful tech entrepreneurs. Founders of companies like Wasoko (which raised over $125M) and Twiga Foods (over $50M) have not only built massive businesses but have also become invaluable mentors and angel investors for the next wave of startups. This recycling of capital and, more importantly, experience, creates a virtuous cycle that accelerates the entire ecosystem's growth. An entrepreneur in Nairobi has access to a deep well of local knowledge on how to scale, fundraise, and navigate the challenges of the African market—a resource that is still nascent in Tanzania.

Tanzania's Paradox: A Land of Potential on Pause

Tanzania is a nation brimming with entrepreneurial potential. It has a massive, youthful population of over 60 million people, rapidly growing internet and smartphone penetration, and one of the most developed mobile money markets in the world. The recent improvement in its global ecosystem ranking shows that the seeds of innovation are sprouting. Success stories like Ramani, a SaaS startup that raised $32 million, prove that world-class companies can be built from Dar es Salaam.

Yet, this potential is being held back by structural impediments.

1. The Policy Vacuum: Unlike Kenya, Tanzania currently lacks a specific law or policy dedicated to startups. Entrepreneurs are forced to navigate a fragmented landscape of SME policies and general business laws that are ill-suited for the fast-paced, often non-traditional models of tech ventures. This ambiguity creates uncertainty and friction, acting as a major deterrent for investors who prize predictability and legal clarity above almost all else.

2. The Bureaucratic Hurdle: The country's #141 ranking in Ease of Doing Business is a significant barrier. In practical terms, this means it takes longer, costs more, and involves more steps to start and operate a company. This bureaucratic friction saps the most valuable resource a startup has: time and energy. It forces founders to focus on compliance rather than innovation.

3. The Nascent Ecosystem: While a startup community exists and is growing, it lacks the density and maturity of Nairobi's. There are fewer support structures, less "old money" from successful tech exits being reinvested, and a smaller, less visible pool of experienced mentors. This forces many promising founders to operate in relative isolation or look outside the country for the support they need to scale.

Blueprints for a National Turnaround: Lessons from Afar

Tanzania's situation is challenging, but far from permanent. Other nations have successfully engineered remarkable transformations by making bold, strategic bets on innovation.

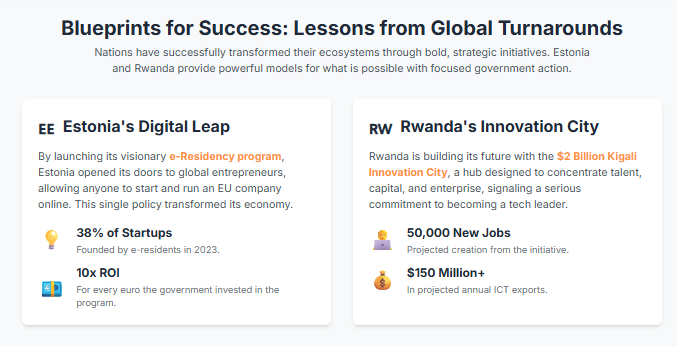

Estonia's Digital Leap: This small Baltic nation transformed its economy with a single, visionary policy: e-Residency. By allowing anyone in the world to start and run an EU-based company entirely online, Estonia detached economic activity from physical geography. The results have been staggering. E-residents founded 38% of all new Estonian startups in 2023, and the government has seen a 10x return on every euro invested in the program. Estonia provides a powerful lesson in how to leverage digital infrastructure to become a global hub for entrepreneurship.

Rwanda's Innovation City: Facing its own development challenges, Rwanda is making a massive, concentrated bet on its future with the $2 billion Kigali Innovation City. This project aims to create a physical center of gravity for tech by co-locating universities, corporations, incubators, and startups. It is a deliberate, top-down strategy to manufacture the ecosystem density that grew more organically in places like Nairobi. With projected outcomes of 50,000 new jobs and over $150 million in annual ICT exports, Rwanda is signaling its ambition to become a continental tech leader.

A Five-Point Roadmap for Tanzania's Tech Renaissance

Drawing on these global success stories and an analysis of its own unique strengths, Tanzania can implement a deliberate, multi-faceted strategy to unlock its immense potential.

- Enact a National Startup Act: This is the foundational first step. A clear, comprehensive Startup Act would be the single most powerful signal to the global investment community. It must define a "startup," provide incentives like tax holidays and simplified IP registration, and create special visas to attract international talent.

- Declare War on Red Tape: The goal must be to make it radically easier to be an entrepreneur in Tanzania. This requires a government-wide commitment to launching a "one-stop" digital portal for all business registrations and permits, slashing processing times, and fostering a culture within government agencies that views startups as national assets to be nurtured.

- Launch a Flagship "Big Bet" Project: Tanzania needs a catalyst, a physical manifestation of its ambition. A project modeled on Kigali Innovation City, perhaps branded as "Silicon Zanzibar" or "Dar Digital City," would create a focal point for talent, capital, and media attention, anchoring the entire ecosystem.

- Fuel the Ecosystem from the Ground Up: While government cannot create a community, it can provide the fertilizer. This means establishing government-backed co-investment funds that match private angel and VC investments, de-risking early-stage ventures. It also means providing grants and support to incubators, accelerators, and university entrepreneurship programs.

- Build on Unique Strengths: Tanzania should not aim to simply copy Kenya. Its strategy must be tailored to its unique advantages. With its globally significant mobile money market, Tanzania is perfectly positioned to become a world leader in fintech. With its vast agricultural sector and extensive coastline, it could become a hub for innovative AgriTech and "blue economy" solutions.

The $800 million gap between Kenya and Tanzania is not a gap of people or potential. It is a gap of policy, process, and infrastructure. The path forward is clear. By enacting bold reforms, making strategic investments, and building on its inherent strengths, Tanzania can close this gap. It can move from a land of potential to a powerhouse of innovation, charting its own course to become a leader in the African century. The time for action is now.