The Anatomy of a Cashless Revolution: Inside Tanzania's "Lipa Namba" Ecosystem

Tanzania is at the forefront of a digital payment revolution, rapidly transforming its economy from one dominated by cash to a landscape where mobile phones are the new wallets. At the heart of this change is a simple but powerful concept: "Lipa Namba," a Swahili term meaning "Pay Number." This unique merchant identifier is the linchpin of a sophisticated ecosystem that is reshaping commerce, enhancing financial inclusion, and setting a new standard for digital infrastructure in Africa.

This transformation wasn't accidental. It's the result of a deliberate, multi-year effort involving innovative mobile network operators (MNOs), a proactive regulator, and a population ready to embrace new technology. The journey from fragmented, company-specific payment systems to a unified, national infrastructure provides a compelling blueprint for a cashless future.

From Walled Gardens to a National Highway: The Evolution of "Lipa Namba"

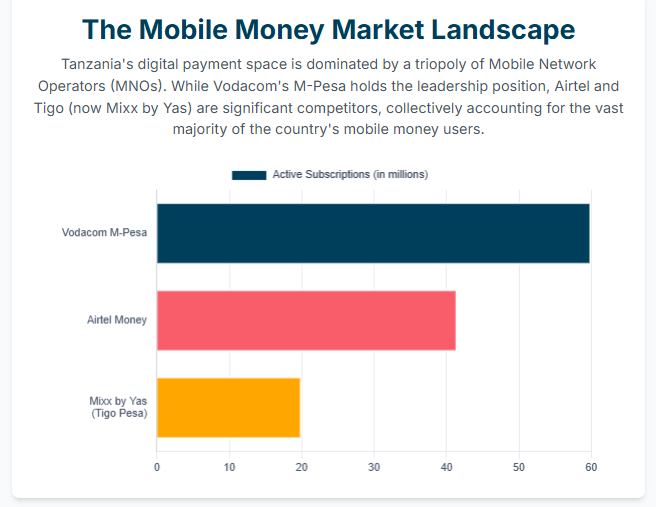

The story of "Lipa Namba" begins with the groundbreaking success of mobile money in Tanzania, pioneered by Vodacom's M-Pesa. Initially, services like M-Pesa revolutionized peer-to-peer (P2P) transfers, allowing millions of unbanked Tanzanians to send and receive money using basic feature phones. This created a large, digitally savvy user base, paving the way for the next logical step: merchant payments.

In the early days, the market was fragmented. Each major MNO launched its own proprietary system, such as Vodacom's "Lipa na M-Pesa" and Airtel's "Lipa Kwa Simu na Airtel Money."These "walled gardens" worked well if you were a customer paying a merchant on the same network, but they created friction and higher costs for cross-network transactions, forcing users to carry multiple SIM cards.

Recognizing that this fragmentation was a barrier to true national progress, the Bank of Tanzania (BoT) evolved from a passive observer to an active architect of the market.The BoT's vision was clear: to create a single, unified, and low-cost payment system for the entire country. This led to two transformative, state-driven initiatives: the Tanzania Instant Payment System (TIPS) and the Tanzania Quick Response (TANQR) code standard.

TIPS is the back-end engine of this revolution. Developed in-house by the BoT, it is a national payment switch that connects all digital financial service providers, including MNOs and banks. By mandating that all inter-provider retail transactions be routed through TIPS, the BoT rendered the old, complex bilateral agreements obsolete. This move was designed to make cross-network payments seamless, instantaneous, and significantly cheaper, leveling the competitive playing field. The system has been a resounding success, processing over 500 million transactions worth more than TZS 18 trillion by the end of the 2024/25 fiscal year.

Complementing this back-end infrastructure is the customer-facing TANQR standard. Before TANQR, a merchant wanting to accept payments from all networks had to display a confusing clutter of different QR codes. The BoT solved this by establishing a single, interoperable QR code standard for the entire country in 2022.Now, a merchant registers with any single compliant provider (a bank or MNO) and receives one universal TANQR code. Any customer with any compliant mobile money or banking app can scan that single code to pay, with the transaction routed seamlessly through TIPS.

The Ecosystem in Action: How It Works for Merchants and Consumers

For a business, getting started with Lipa Namba is a structured process designed to be both accessible and secure.

Merchant Onboarding: The "Know Your Customer" (KYC) requirements vary based on the business structure.

- Sole Proprietors: The process is straightforward, typically requiring a National ID (NIDA). A business license and Taxpayer Identification Number (TIN) may also be needed.

- Limited Companies: The documentation is more extensive, including the certificate of incorporation, business license, TIN, a memorandum of understanding (MOU), and NIDA IDs for major shareholders.

Once registered, merchants gain access to a suite of digital tools.

Merchant mobile apps, like the M-Pesa for Business app, allow for real-time transaction tracking, statement generation, and even managing staff access.

Web portals offer more comprehensive dashboards and, crucially, allow merchants to settle funds from their digital till directly into their linked company bank account.

A key feature of the system is the hierarchy of tills. Businesses can have a Main Till ("Lipa Namba Kuu") and create an unlimited number of "Child Tills" ("Lipa Namba Ndogo"). This allows a business to assign unique tills to different cashiers or branches for granular tracking, while all funds are consolidated in the main till for centralized management.

The Consumer Experience: For consumers, the system is designed for maximum accessibility.

- USSD Menus: Users of basic feature phones can pay by dialing a simple code (e.g.,

*150*00#for M-Pesa) and navigating a text-based menu. This ensures that internet connectivity is not a barrier to participation. - Mobile Apps and QR Codes: For smartphone users, dedicated apps from MNOs and banks provide a more intuitive experience. The simplest method is scanning the merchant's universal TANQR code, which automatically populates the payment details, eliminating the risk of manual entry errors.

The Economic Impact and Lingering Challenges

The shift to digital payments has had a profound, measurable impact on Tanzania's economy.

Benefits:

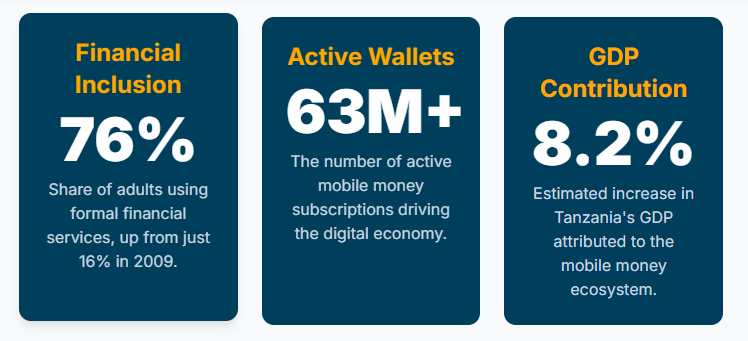

- Financial Inclusion: Mobile money has been the single biggest driver of financial inclusion. The percentage of adults using formal financial services skyrocketed from a mere 16% in 2009 to76% by 2023. The country now boasts over 63 million active mobile money wallets.

- Economic Growth: A 2023 analysis estimated that mobile money has increased Tanzania's GDP by as much as 8.2%, a contribution on par with the entire manufacturing sector.

- Security and Efficiency: For merchants, digital payments eliminate the risks of theft and counterfeit cash. It also creates an automatic digital record, simplifying accounting and business formalization.

- Access to Credit: This digital transaction history acts as "data collateral". It allows financial institutions to assess a merchant's creditworthiness, providing access to services like merchant loans that are crucial for SME growth.

Persistent Hurdles: Despite the immense success, challenges remain. The most significant is the cost of transactions. Fees charged to consumers for sending money and to merchants for withdrawing funds or transferring them to a bank remain a barrier. This cost structure has led to an inefficient workaround known as "disguised withdrawals." Because it's cheaper to make a "Pay to Business" (P2B) payment than to formally cash-out at an agent, some customers will "pay" a merchant's Lipa Namba and receive cash in return, bypassing the more expensive channel. This practice inflates P2B transaction data and highlights the market's sensitivity to cost.

The Future is Digital: Tanzania's Vision 2050

Tanzania's cashless revolution is a core component of its national strategy. The government's

"Vision 2050" aims to transform the nation into a high-income economy, with digitalization as a central pillar. The creation of TIPS and TANQR are direct steps toward this goal.

The future will likely see further expansion into cross-border payments—TIPS is slated to process all international money transfers starting in August 2025—and the adoption of more advanced technologies like AI for fraud prevention and personalized services.

Tanzania's journey provides a powerful case study. By combining private sector innovation with bold, top-down regulatory vision, the country has built a digital public infrastructure that is driving economic growth and creating a more inclusive financial system for all its citizens. It is a revolution not just in payments, but in possibility.