The Digital Caravan: How Ramani is Rewiring Tanzania's Commerce, One Micro-Distributor at a Time

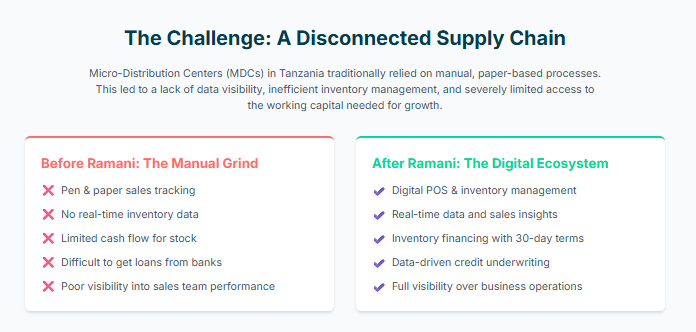

Step into any neighborhood in Dar es Salaam, and you’ll feel it: the vibrant, relentless pulse of commerce. It’s in the colorful kiosks, the bustling storefronts, and the handcarts navigating crowded streets, all part of a complex network that gets everyday products—a cold soda, a bag of rice, a bar of soap—into the hands of millions. This is the world of Fast-Moving Consumer Goods (FMCG), a market in Africa valued at over a trillion dollars. For decades, this intricate dance has been choreographed by pen, paper, and cash-on-delivery. It’s a system built on relationships and grit, but one that is notoriously fragmented, opaque, and starved of the capital needed to grow.

This is the challenge that brothers Iain and Calvin Usiri returned home to solve. Armed with world-class tech experience and a conviction to make a tangible impact, they founded Ramani in 2019. More than just a software company, Ramani is building the financial infrastructure for Africa’s supply chains, transforming once-invisible data trails into pathways for credit and growth. This isn't just a story about a startup; it's about a fundamental rewiring of a nation's economic engine, moving it from analog tradition to a digital future.

The Founders' Homecoming: A One-Way Ticket to Impact

The Ramani story doesn’t start in a boardroom in Tanzania, but in the corridors of Silicon Valley and the lecture halls of Stanford University. Iain Usiri, a Stanford computer science graduate, had built a career as a product manager at Salesforce. His brother, Calvin, an entrepreneur with a love for technology, was building enterprise software at Capgemini. They were living a version of the immigrant dream, a path well-trodden by talented minds from across the globe.

But a different dream was calling them home. "My college essay was about returning home and building infrastructure for my community," Iain shared in an interview. The desire wasn't just to succeed, but to build something of lasting significance in the place that raised them. The brothers, along with a close friend, began to question their path. The potential for impact in Tanzania, they realized, far outweighed any success they could achieve in the U.S.

So, in 2019, they made a decision that many would call audacious: they booked a one-way flight back to Dar es Salaam. They leveraged their savings as their initial seed capital, a tangible bet on themselves and their vision. This wasn't a case of "brain drain," but of "brain gain"—a conscious choice to bring their global experience to bear on local problems. Their first mission was to find a problem big enough to warrant their bet, and their focus quickly turned to the lifeblood of the local economy: the CPG supply chain.

Three Iterations to the "Aha!" Moment

Ramani’s current, elegant model of combining software with financing wasn’t born overnight. It was forged through direct experience and a willingness to pivot. The founders’ journey to their core product reveals a deep understanding of the market they aimed to serve.

Their first venture was not as a tech company, but as CPG distributors themselves. They bought a warehouse, managed a fleet of vehicles, and hired a team of salespeople. They lived the daily grind they wanted to fix: the chaotic paperwork, the challenge of tracking inventory in real-time, the constant cash flow crunch, and the difficulty of monitoring a sales team in the field. This firsthand experience was invaluable, providing them with unparalleled empathy for their future customers.

This led to their second iteration: building a Software-as-a-Service (SaaS) platform to help other distributors manage their operations. They created an app with a point-of-sale (POS) system, inventory management tools, and procurement features. The software worked, but they soon hit a wall. While distributors saw the value in digitization, their most pressing problem wasn't a lack of software; it was a lack of cash. They were so constrained by working capital that they couldn't afford to buy enough inventory to meet demand, making operational efficiency a secondary concern.

It was this realization that sparked their third and final pivot—the "aha!" moment that defines Ramani today. The data their software was collecting wasn't just an operational tool; it was a treasure trove of financial information. It showed exactly how much a distributor was selling, how quickly they were moving specific products, and the health of their business in real-time. This data could do what traditional banks couldn't: accurately assess the creditworthiness of these businesses.

By combining their SaaS platform with inventory financing, they could solve the entire problem. This innovative model earned them a coveted spot in Y Combinator's Winter 2020 batch, validating their approach and providing the fuel to scale their vision.

The Ramani Flywheel: How Data Unlocks Growth

At its core, the Ramani model is a virtuous cycle—a flywheel that gathers momentum with every transaction. It works in four distinct steps:

- Digitize: A micro-distribution center (MDC) adopts Ramani’s platform. Salespeople are equipped with a mobile POS app—available in English and Swahili, and functional both online and offline—to record sales and issue receipts. The warehouse manager uses an inventory management application, and procurement is streamlined through a simple WhatsApp integration. Instantly, a business that ran on paper is brought into the cloud.

- Analyze: As the MDC operates, every sale, every stock movement, and every order generates a digital footprint. Ramani's system captures this data, providing the business owner with unprecedented real-time visibility. They can track their sales team’s performance, see which products are selling fastest, and know their exact inventory levels at any moment.

- Finance: This is the game-changer. Ramani’s platform analyzes the MDC's sales data to underwrite them for inventory financing. Based on their demonstrated ability to sell, Ramani provides a credit limit. The process is seamless: the distributor orders inventory (for example, from a major supplier like Coca-Cola), Ramani pays the supplier on day zero, and the distributor receives the goods. The distributor then has 30 days to sell the inventory and repay Ramani, plus a small commission.

- Grow: Freed from the constraints of cash-on-delivery, the MDC can now stock more inventory, avoid costly stockouts, expand their customer base, and increase their sales volume. This growth generates even more data, which in turn allows Ramani to confidently increase the distributor’s credit limit. This creates a powerful feedback loop where technology directly fuels business expansion.

The Ripple Effect: A New Era for Tanzanian Commerce

The impact of Ramani's model is not theoretical; it is measured in millions of dollars and transformed businesses. To date, the company has disbursed over $210 million in cumulative loans, with an average loan size of $47,000, demonstrating that they are fueling the growth of substantial small and medium-sized enterprises.

The trust Ramani has built is evident in its partnerships. It works with global giants like Coca-Cola and Diageo, providing them with a reliable way to finance their distribution networks. On the capital side, Ramani has partnered with leading financial institutions like Stanbic Bank and Tanzania Commercial Bank, creating a "Financial Marketplace" that channels capital efficiently to where it's needed most.

For business owners, the change is profound. One client, David Wangwe of Dalu General Traders, reported that Ramani’s services helped reduce his business debt by over 35%. Others speak of gaining seamless visibility over their stock for the first time or being able to expand their product offerings because they finally have the financial freedom to do so.

By transitioning Africa's supply chains from pen and paper to the cloud, Ramani is doing more than improving efficiency. It is creating a new layer of financial inclusion, empowering a generation of entrepreneurs, and building a blueprint that could be replicated across the continent. The journey that started with a one-way ticket is now paving a digital highway for Tanzanian commerce, proving that the greatest innovations often arise from a deep understanding of home.