The Digital Duka: Inside Tanzania's High-Stakes Race to Build the Ultimate Super App

In the bustling markets of Dar es Salaam and the quiet rural villages across Tanzania, a digital revolution is unfolding. It’s not happening in gleaming skyscrapers or high-tech labs, but on the screens of millions of mobile phones. This is the race to build Tanzania's definitive "Super App"—a single, all-in-one platform to manage every aspect of daily life, from sending money and paying for groceries to getting a loan and shopping online.

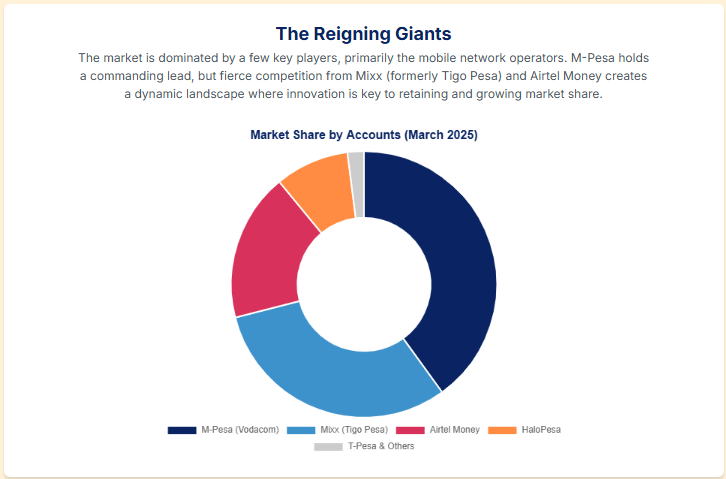

This isn't just a battle of technology; it's a high-stakes contest to solve a uniquely Tanzanian puzzle. The main players are the entrenched telecommunications giants, Vodacom's M-Pesa and Axian's Mixx (formerly Tigo Pesa), who are leveraging their massive scale against nimble, venture-backed fintech like Nala. The winner won't be the company that copies models from Asia or the West, but the one that understands the complex, contradictory reality of the Tanzanian market.

A Battlefield of Contradictions

To understand the Super App race in Tanzania, you have to grasp a central paradox: it is a profoundly mobile-first nation where most people don't have smartphones. With over 92 million mobile subscriptions for a population of around 67 million, mobile penetration is a staggering 136%.Yet, smartphone penetration hovers at just 37%.The vast majority of Tanzanians still rely on basic feature phones, navigating the digital world through text-based USSD menus.

This reality splits the market in two and dictates the rules of engagement. Any app that only caters to the slick, data-heavy smartphone experience automatically excludes more than 60% of its potential customers. Success requires a hybrid approach: a sophisticated app for the growing urban user base and a robust, accessible USSD alternative for everyone else.

This is where the incumbent telcos, Vodacom and Tigo (now Yas), hold a powerful, almost unassailable advantage: the ability to "zero-rate" data. As owners of the network infrastructure, they can make their own Super Apps free to use, meaning customers can browse, transact, and manage their finances without burning through their precious data bundles. For a price-sensitive consumer, the choice between a free-to-use app and one that costs them money is no choice at all. This creates a formidable competitive moat that independent fintech struggle to cross.

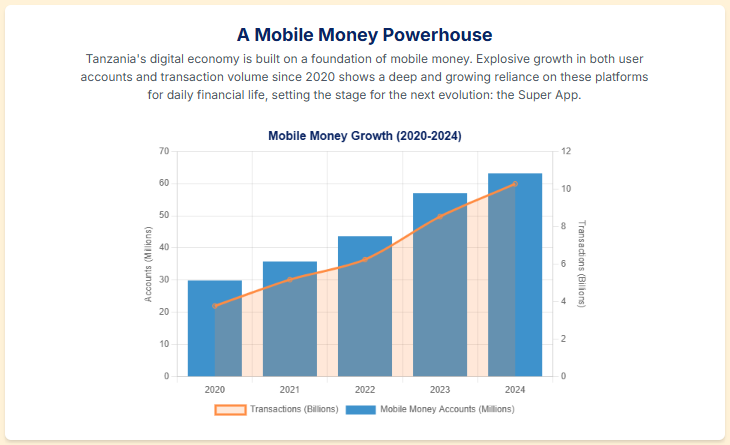

The entire contest is built on the foundation of mobile money. With a transaction value of $80 billion in 2024, it is the undisputed bedrock of Tanzania's digital economy. However, the system is still tied to its legacy. Most transactions happen via USSD, and a deep-seated habit of "cashing out"—immediately converting digital money back into physical cash—persists. The central challenge for any aspiring Super App is to break this cycle and create a compelling digital ecosystem where users want to keep their money online.

The Titans: M-Pesa's Fortress vs. Mixx's Open Innovation

Leading the charge are the two titans of Tanzanian telecoms. M-Pesa (Vodacom): The Undisputed King M-Pesa is more than a service; it's a national institution. Commanding over 40% of the mobile money market with more than 26 million users, it is the platform against which all others are measured. Vodacom is doubling down on this dominance with a massive $100 million investment to modernize its platform, aiming to build a fortified "walled garden" of services.

Its strategy is one of ecosystem lock-in. By bundling essential financial services like micro-loans (M-Pawa) and savings (M-Koba) directly into its wallet, M-Pesa creates powerful switching costs. A customer who relies on M-Pawa for a small loan is highly unlikely to move their primary account to a competitor. However, this scale comes with a vulnerability. User reviews of the M-Pesa app frequently cite instability, crashes, and an outdated interface, revealing a gap between its market power and its user experience. This creates a clear opening for a more agile rival.

Mixx by Yas (Tigo): The Agile Challenger As the strong number two player with over 20 million accounts, Mixx isn't trying to beat M-Pesa at its own game of scale. Instead, it's trying to outmaneuver it with strategic innovation. Its masterstroke has been a pioneering integration with WhatsApp, allowing customers to check balances, pay bills, and send money from within the world's most popular messaging app.

Furthermore, in a crucial partnership with Mastercard and payment aggregator Selcom, Mixx allows users to generate a virtual card linked to their mobile wallet. This single move unlocked the global digital economy, enabling users to pay on international e-commerce sites—a capability once reserved for the banked elite. This strategy of openness is a direct challenge to M-Pesa's closed ecosystem, but it carries its own risks. By building user habits on WhatsApp, Mixx becomes dependent on a platform controlled by Meta, which could one day launch its own native payment service in the region and turn from a partner into a powerful competitor.

The Disruptor: Nala's Global Gambit

While the telcos battle for domestic supremacy, a new type of challenger has emerged. Nala, a Tanzanian-founded fintech, has wisely sidestepped a direct confrontation. After an early attempt at a domestic payment app was met with resistance from incumbents, the company pivoted to focus on the lucrative but inefficient market of international remittances.

The strategy was a resounding success. Nala has since raised over $50 million, processed over $1 billion in transactions, and achieved profitability while serving over 500,000 members of the African diaspora in the US, UK, and EU.

But this is just the first step. Nala is using its funding to build "Rafiki," a business-to-business (B2B) payments platform designed to become the underlying infrastructure for global commerce into Africa. Instead of competing to be the consumer's Super App, Nala aims to be the "dLocal for Africa"—the essential payment rails that M-Pesa and Mixx will eventually need to plug into. It’s a brilliant strategic move that reframes the competition, positioning Nala as a critical partner to the telcos, not a rival.

The Winning Formula: Payments, Lending, and the Future

So, what services will ultimately win the Tanzanian market?

- Payments are the foundation. The real prize is digitizing the millions of daily transactions at the local shop, or duka. Government initiatives promoting interoperable QR codes (TanQR) are leveling the playing field, forcing providers to compete on user experience and value-added services rather than just the size of their network.

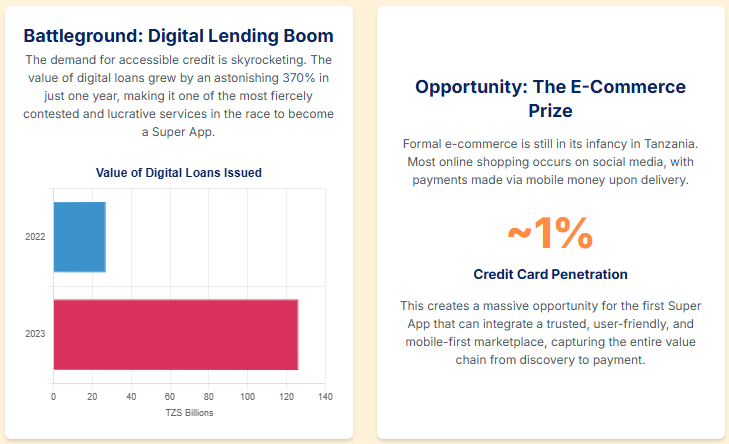

- Digital Lending is the engine. The digital credit market in Tanzania is exploding, with the number of loan accounts surging by nearly 200% in 2023 alone. For users, instant access to small loans is a powerfully "sticky" feature that locks them into an ecosystem. For providers, it's a profitable revenue stream and, more importantly, the primary source of the rich user data needed for credit scoring and cross-selling other products.

- E-commerce and Messaging are integrations, not standalones. The winning Super App won't try to build an Amazon competitor from scratch—a path where others, like Jumia, have struggled. Instead, it will enable e-commerce by providing the payment tools for thousands of small merchants selling on social platforms like WhatsApp and Instagram.

The Final Verdict

The race for Tanzania's Super App won't have a single winner. Instead, we are likely to see a stratified market with clear leaders in different domains.

M-Pesa, with its immense scale and brand trust, is poised to remain the dominant B2C player for the mass market, provided it can finally deliver a world-class app experience. Mixx will continue to challenge it, capturing the more digitally-savvy urban youth with its innovative partnerships. Meanwhile, Nala is on a clear trajectory to become the indispensable B2B payments infrastructure for the entire region.

The future of finance in Africa is not being forged in Silicon Valley. It's being built right now, transaction by transaction, in the dynamic and demanding digital landscape of Tanzania. The companies that succeed will be those that listen, adapt, and solve real-world problems for millions of people.