The Fintech Hybrid: Why Selcom’s Banking Play is a Blueprint for Africa’s Financial Future

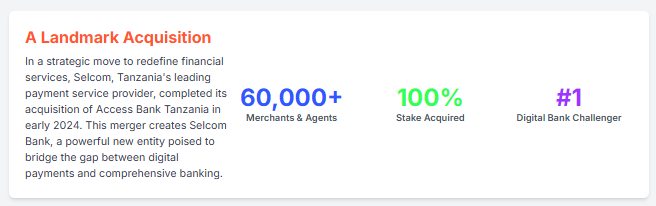

The African fintech landscape is in a constant state of dynamic evolution, but every so often, a single move redraws the entire map. In early 2024, Selcom’s acquisition of Access Bank Tanzania was precisely that—a seismic event. On the surface, it was a straightforward corporate transaction: Tanzania's largest payment service provider buying a commercial bank. But to see it merely as such is to miss the forest for the trees. This isn't just a story about a merger; it's the prologue to a new chapter in African finance. Selcom's bold maneuver is a declaration that the future doesn't belong to traditional banks or agile payment apps alone. It belongs to the hybrid.

This strategic fusion of payments and banking creates a powerful new entity, Selcom Bank, poised to solve the continent's most persistent financial challenges. It is a calculated move to build a comprehensive ecosystem that offers the speed and reach of mobile money with the trust and product depth of a legacy financial institution. More than just a local success story, the Selcom model provides a compelling blueprint for how to achieve true financial inclusion and build the next generation of financial super-apps across the continent.

A Continent Primed for a New Model

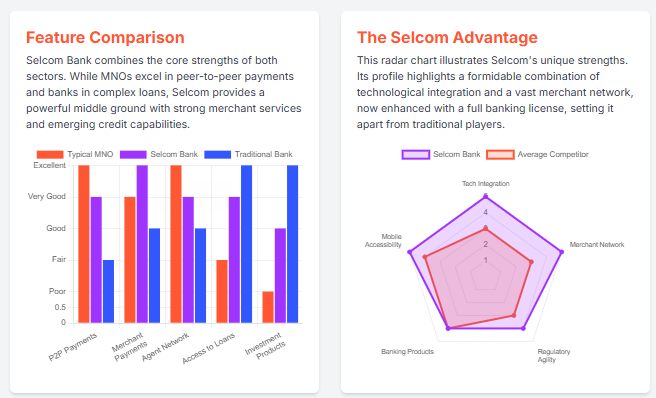

To understand the genius of Selcom's play, one must first appreciate the unique financial terrain of sub-Saharan Africa. For over a decade, the story has been one of a stark dichotomy. On one hand, you have explosive mobile penetration. Mobile phones are ubiquitous, and with them, mobile money has become the de facto standard for daily transactions. Led by pioneers like Safaricom’s M-Pesa, Mobile Network Operators (MNOs) built staggering agent networks and successfully banked millions who had never set foot in a traditional bank branch. They solved the problem of payments with breathtaking efficiency.

On the other hand, you have the traditional banking sector. While secure and offering a wider range of services like loans, mortgages, and investment products, banks have struggled to break free from their brick-and-mortar legacy. Their cost structures are high, their digital interfaces often feel clunky, and their stringent risk models have historically excluded the vast majority of the population—the small-scale farmers, the informal merchants, the gig economy workers—from accessing credit and other wealth-building tools.

This created a vast, underserved middle ground. An individual could easily receive payment via mobile money but had no viable path to secure a loan to grow their business. A merchant could accept digital payments through a service like Selcom but struggled to get working capital from a bank that didn't understand their cash flow. The continent was saturated with transaction tools but starved of financial mobility. Selcom was sitting right in the middle of this gap, processing transactions for over 60,000 merchants and millions of individuals, holding a treasure trove of data that traditional banks could only dream of. The only thing missing was the license to use it.

Deconstructing the Strategy: From Payments to Possibilities

Acquiring a full banking license was the masterstroke that unlocked the full potential of Selcom's position. It’s a multi-faceted strategy that transforms the company from a simple intermediary into a central, indispensable financial hub for its users.

First and foremost, the license grants trust and regulatory legitimacy. While fintechs have earned user trust through convenience, a government-backed banking charter carries a unique weight. It assures customers that their deposits are protected and that the institution operates under the highest standards of oversight, a crucial factor when asking people to move beyond simple transactions to manage their entire financial lives on a platform.

Second, it allows for explosive product expansion. A payment provider is, by its nature, limited. Its revenue is tied to transaction volume. A bank, however, can build deeper, more profitable relationships. Selcom Bank can now move to offer services with much higher margins:

- Digital Savings Accounts: Providing a seamless way for users to save, directly linked to their payment activities.

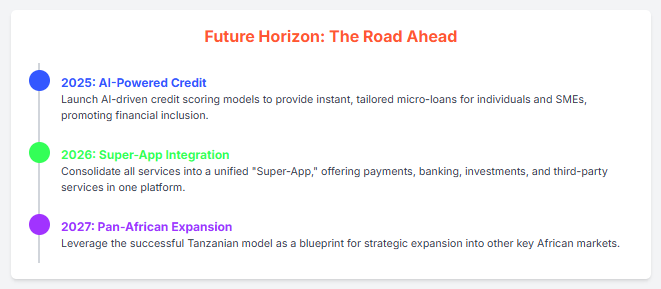

- Credit and Lending: This is the crown jewel. By leveraging its vast repository of transactional data, Selcom can build sophisticated, AI-driven credit scoring models. They can assess the creditworthiness of a small merchant based on years of actual sales data, not on the collateral they may not have. This allows for the disbursement of instant, tailored micro-loans to the very individuals and SMEs previously deemed "unbankable."

- Bancassurance and Investments: The platform becomes a gateway to other financial products, allowing users to buy insurance or make micro-investments with unprecedented ease.

This ecosystem play creates immense "stickiness." When a customer's payment, saving, and credit needs are all met within a single, intuitive app, the incentive to leave evaporates.

The Hybrid Vigor: Forging a New Market Position

Selcom Bank is no longer just a fintech, an MNO, or a bank. It is a new category of financial institution that embodies the principle of "hybrid vigor"—combining the best traits of its predecessors to create something stronger and more adaptable.

It has the reach and agility of an MNO, built on a lightweight, digital-first infrastructure without the burden of expensive physical branches. It understands user experience and can innovate at the speed of a tech company. Simultaneously, it wields the product suite and regulatory authority of a bank, allowing it to offer the complex financial instruments necessary for genuine economic empowerment.

This hybrid model fundamentally reshapes the competitive landscape. Traditional banks are now forced to compete with an entity that has a lower cost base, a better user experience, and a richer dataset on the most dynamic segment of the economy. MNOs, which have long dominated the payment space, now face a competitor that can offer something they can't: a clear pathway to credit and wealth creation. Selcom is not just playing their game; it has changed the rules of the game itself.

The Future is Hybrid: A Blueprint for Africa

The implications of Selcom's move extend far beyond Tanzania's borders. It serves as a powerful and practical blueprint for fintech innovators across Africa. The core lesson is that dominating a single vertical, like payments, is no longer the end goal. The goal is to build a fully integrated ecosystem, and owning the banking license is the most effective way to do so.

We can expect to see a wave of similar moves. Major payment providers, ride-hailing companies with payment arms, and other data-rich tech firms will increasingly seek to acquire or apply for banking charters. This trend will accelerate financial inclusion at a pace that neither MNOs nor traditional banks could achieve alone. It will unlock trillions of dollars in economic potential by finally extending credit to the informal sector, which forms the backbone of most African economies.

Of course, the path forward is not without its challenges. Integrating the nimble, fast-paced culture of a tech company with the compliance-heavy, risk-averse culture of a bank is a monumental task. Regulatory scrutiny will intensify as these hybrids become more systemically important, and the ever-present threat of cybersecurity will grow in lockstep with their expanding digital footprint.

Nonetheless, the die is cast. The Selcom-Access Bank deal was not just an acquisition; it was a metamorphosis. It was the moment a caterpillar of a payment company entered the chrysalis of a banking charter, poised to emerge as something entirely new. It is a bold, visionary step that signals the maturation of the African fintech market and lights the way toward a more inclusive and prosperous financial future for the entire continent.